Millennials also are much more likely to have a prepaid card than a credit card. A Bankrate survey found that almost two-thirds of 18 – to 29-year-olds don’t have credit cards. But WHY?

For our younger millennials, many have been raised using a pre-paid card given to them by their parents and used a teaching method to manage their finances and to prevent any overdraft issues.

With some of the older millennials, they may have had issues with credit card debt and strive to find ways to manage their finances without penalties for overspending.

The generation before grew up with getting a checking account at 18 being a rite of passage and credit card offers flooding their mail boxes as soon as they started college. This was the norm – but not anymore.

Many millennials have grown up with parents telling them to “stay away from debt”, don’t let credit cards get you in trouble, overdraft fees will kill you – manage your money better.” And guess what…they are listening.

“Millennials seem to like to compartmentalize their spending,” says Tami Farrow, senior vice president and head of retail deposit payments at TD Bank, which recently studied Millennials and prepaid cards. Rather than using separate, old-fashioned paper envelopes to stash the money they spend on rent, food, gas and other expenditures, they may use prepaid card sub accounts to serve that purpose, she says.

In fact, nearly 60% of the millennials surveyed by TD Bank said the cards help them to keep track of spending, a rate that’s far higher than other age groups.

More than half use the cards for paying bills online. They’ll go to the biller’s website and make an instant payment, Farrow says. That immediacy appeals to younger consumers.

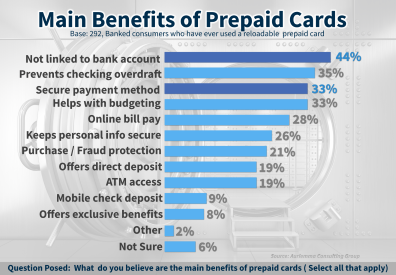

Millennials also say they like prepaid cards for their:

- Convenience.

- Privacy and security protection.

- Overdraft prevention on their checking accounts.

Unlike a credit card, prepaid cards don’t require a credit check, which can be important for someone just starting to build a credit history, Farrow says.

Prepaid is no longer seen as lower is prestige, or only for someone who cannot open a banking account – they are seen as a method to manage finances better, even if they incur fees that are higher than most checking accounts incur.

They see this as a way to pay for the service and the means to pay electronically without having to incur credit card interest rates or overdraft fees.

Is this just a phase, or here to stay?

The Millennial trend of electronic payments with pre-paid is not going away – in fact you are seeing Big Box stores like Walmart partnering with American Express to offer the Bluebird card along with other prepaid services.

The investment they have made to form this partnership shows that both entities see the revenue this can bring in and the huge impact it can have on the regional banks.

I wonder if Banks and Credit Unions have really looks to see how much of their business is moving to pre-paid cards, and based on their finding are they seeing a need to re-invent their own programs or even start one. THIS is a NOW issue and you are being replaced.

So – how do you compete at the Regional Level?

Maybe the question is why do financial institutions not like deal with Prepaid – we have heard things like: See our responses in italics

- We are seeing Fraud Attracts on these accounts

- We offer a Pre-Paid Card with EMV chip security, geofencing and more to help combat this.

- The company I am currently working with is based overseas and communication is very tough and inconsistent.

- We are based in the US, our call center is based in Denver, CO

- We know Debit but have never found the right formula to be successful in the prepaid or payroll market.

- We cut our teeth in the prepaid market – we have a proven track record of success in these types of programs

- We incur delays and high fees when we order our prepaid card through our current service bureau. Most people want the card right then.

- You’re exactly right – why not run your prepaid program like any other instant issuance program – the same goes for your payroll – we can help you set up an issuance system you manage in house.

- If you already have an Instant Issuance provider and want to manage this program separately – we have the perfect solution for that.

- Settlement reporting is not the way we want it.

- Let’s fix that! We have experts in settlement on staff and we can customize reports to meet your needs. You’re the customer – let’s make the customer happy.

Have I peeked your interest? We are part of an issuing processor whose goal is to let you create YOUR OWN RAILS! We know the business processing and we know the limitations many in your industry have dealt with for years. But just like the millennials – it is time to make some changes.

Let us help you capture that business back and create innovative ways to bring that business back in house and create new revenue streams for your institution.